How to trade in Forex Market

India’s currency market operates under the same rules as those in other nations. The following steps will help you begin trading foreign exchange in India:

1. Educate Yourself

Acquire a thorough grasp of the dynamics, vocabulary, trading approaches, and risk management of the forex market. Learn how to read charts and indicators, as well as technical and fundamental analysis.

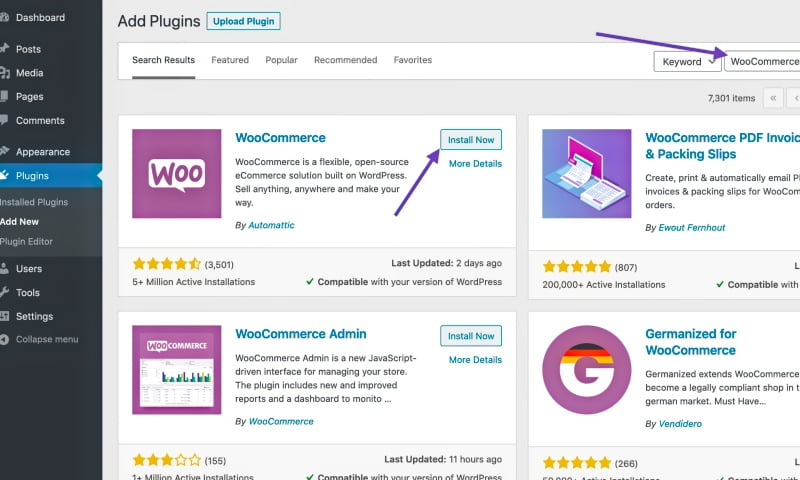

2. Select a Reputable Broker

Decide on a trustworthy forex dealer who is subject to Securities and Exchange Board of India (SEBI) regulation. Make sure they have a straightforward trading interface, aggressive spreads, effective customer service, and a variety of currency pairings

3. Open a Trading Account

Complete the broker account opening procedure. Typically, this entails supplying the required papers and identity documents. Additionally, you might need to add money to your trading account.

4. Create a Trading Plan

Create a detailed trading plan that defines your objectives, risk tolerance, preferred trading approach, and intended trading methods. You can make educated selections and control your emotions when trading with the aid of a well-defined plan.

5. Use a demo account to practice trading

Most brokers provide demo accounts that let you trade with fake money. Use this tool to test out alternative techniques, practice your tactics, and become comfortable with the trading platform without risking real money.

6. Analyze the forex market

using technical and fundamental analysis by using a variety of tools, indicators, and charts. While fundamental study examines news events and economic variables that affect currency prices, technical analysis focuses on previous price patterns.

7. Manage Risk

Use effective risk management strategies to safeguard your financial resources. Utilise suitable position sizing based on your risk tolerance and the volatility of the currency pair you are trading. Set stop-loss orders to minimize possible losses.

8. Keep an eye on market conditions

by following market news, economic indicators, and geopolitical developments that may have an impact on exchange rates. Use economic calendars and news feeds as tools to keep track of pertinent information.

9. Execute Trades

After determining a trading opportunity based on your analysis, place your transaction using the broker’s trading platform. Set your entry and exit positions, choose your preferred currency pair, and determine the transaction size.

10. Monitor and Modify

After starting a transaction, keep a close eye on how it is developing. In order to safeguard profits when the trade goes in your favor, think about using trailing stop orders and adjust your stop-loss and take-profit levels as appropriate.

11. Review and learn

Consistently evaluate your trading abilities by tracking your trades and examining both profitable and unsuccessful deals. Maintain your knowledge, modify your tactics, and gain insight from your experiences.

Keep in mind that trading currencies have significant risks, therefore you should only risk money you can afford to lose. Prior to beginning your forex trading journey, it is advised that you speak with a financial counselor or experienced trader.

Read This: How to grow your business with AI

Forex market trading platforms in India

In India, there are several forex trading platforms accessible. Here are a few well-known examples:

1. MetaTrader 4 (MT4)

One of the most popular forex trading platforms globally is MetaTrader 4 (MT4). It provides a full suite of technical analysis tools, adaptable charts, and a user-friendly interface. As their main trading platform, MT4 is offered by several brokers in India.

2. MetaTrader 5 (MT5)

The upgrade of MT4’s features and functionality is known as MT5. It offers new order kinds, more sophisticated technical analysis tools, and an integrated economic calendar. Some brokers in India do provide MT5, despite it not being as popular as MT4.

3. cTrader

Another well-liked trading platform, cTrader is renowned for its quick transaction execution and sophisticated charting features. It provides a large selection of order kinds, level II pricing, and an intuitive interface. However, compared to MT4, cTrader is less often provided by brokers in India.

4. Zerodha

One of the biggest retail stockbrokers in India, Zerodha, has a trading platform called Kite that supports FX trading. Along with real-time market data, sophisticated charting tools, and order-placing options, Kite offers a user-friendly interface.

5. Upstox Pro

Another well-known stockbroker in India, Upstox, offers the trading platform Upstox Pro. Together with other financial products, it provides FX trading. The website offers extensive charting capabilities, real-time market data, and order-placing options.

6. 5Paisa Trader Terminal

5Paisa, a well-known brokerage company in India, provides a trading platform called 5Paisa Trader Terminal. Forex trading is among the several asset groups that are permitted. The portal provides customizable charts, technical analysis tools, and real-time streaming quotations.

It’s crucial to take into account aspects like dependability, user interface, features offered, charting capabilities, and compatibility with your preferred broker when choosing a trading platform. Make sure the platform also allows you to access the currency pairings you want to trade.

Always select a platform provided by an established broker, and confirm that it is governed by the relevant Indian regulatory bodies, such as the Securities and Exchange Board of India (SEBI).

Also read: Top 10 web development Firms in Mumbai

International forex market trading platforms

Traders from around the world utilize a variety of international forex trading platforms. Here are a few well-known examples:

The above-listed MetaTrader 4 (MT4), MetaTrader 5 (MT5) & cTrader is also valid for international forex trading.

1. NinjaTrader

Among experienced traders, NinjaTrader is a robust trading platform. It features sophisticated charting tools, backtesting options, and the capacity to create and implement unique trading plans using NinjaScript. Futures and FX traders are the most common users of NinjaTrader.

2. Interactive Brokers (IBKR)

Trader Workstation (TWS), a well-known brokerage company’s proprietary trading platform, is offered by Interactive Brokers (IBKR). TWS provides access to several marketplaces, including the FX market, a large variety of trading instruments, and sophisticated order types.

3. SaxoTrader

Saxo Bank, a respected worldwide bank, provides SaxoTrader as a trading platform. It offers access to a variety of financial products, such as stocks, commodities, currency, and more. Advanced charting, analytical tools, and risk control capabilities are provided by SaxoTrader.

4. eToro

eToro is a social trading platform that enables users to participate in a trading community and mimic the moves of winning traders. It provides access to several markets, including forex, and has a user-friendly design as well as social trading capabilities.

5. 5Plus500

Plus500 is an online trading platform that gives users access to a variety of markets, including those for cryptocurrencies, commodities, indices, and foreign exchange. It provides a straightforward design that is easy to use, real-time market quotations, and a selection of trading instruments.

Consider elements like dependability, accessible markets and instruments, charting capabilities, order kinds, and the broker’s reputation when selecting an international forex trading platform. It’s essential to confirm the broker delivers dependable customer service and is governed by the proper financial authorities in each country.