In a world where uncertainties loom large, having the best insurance is a crucial aspect of financial planning. Whether you’re safeguarding your health, assets, or loved ones, finding the right insurance coverage is paramount. This comprehensive guide explores the intricacies of selecting the best insurance policies to meet your unique needs.

Must Read: What are the things covered in flood insurance?

Understanding the Importance of Best Insurance

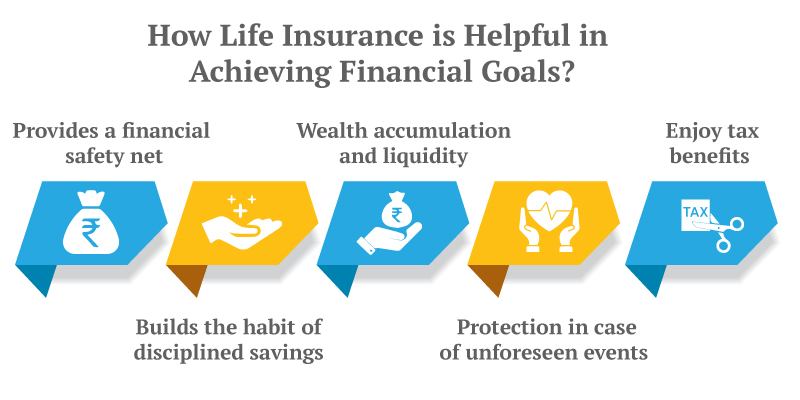

Before delving into the nitty-gritty details, let’s emphasize the significance of having the best insurance. Insurance acts as a safety net, providing financial protection in the face of unexpected events. From medical emergencies to unforeseen damages, having the right coverage ensures you’re prepared for whatever life throws your way.

Navigating the Landscape of Insurance Options

1. Health Insurance: Ensuring Your Well-being

Your health is your wealth, and investing in the best health insurance is a paramount decision. Explore policies that not only cover medical expenses but also offer additional benefits such as preventive care and wellness programs.

2. Auto Insurance: Safeguarding Your Vehicles

When it comes to your vehicles, having the best auto insurance is non-negotiable. Look for policies that provide comprehensive coverage, including liability, collision, and uninsured motorist protection, ensuring you’re covered in any driving scenario.

3. Home Insurance: Protecting Your Haven

Your home is your sanctuary, and the best home insurance policy is essential to protect it. Explore coverage options for structural damage, personal belongings, and liability, tailoring the policy to your specific property and needs.

4. Life Insurance: Securing Your Loved Ones’ Futures

Thinking about the future is integral, and the best life insurance offers peace of mind. Consider term life or whole life policies based on your circumstances, ensuring your loved ones are financially secure in the event of the unexpected.

Also Read: How to Choose the Best Accident Lawyer for Your Case

Decoding the Language of Insurance Policies

Understanding insurance jargon is key to making informed decisions. Familiarize yourself with terms like premiums, deductibles, and coverage limits. By doing so, you empower yourself to choose policies that align with your budget and expectations.

The Art of Comparison: Finding Your Perfect Policy

5. Comparing Quotes: The Gateway to Savings

To secure the best insurance deals, compare quotes from multiple providers. Look beyond the price and examine coverage details, customer reviews, and claim processes. This meticulous approach ensures you make a well-informed decision.

6. Bundle Up for Savings: Multi-Policy Discounts

Consider bundling your insurance policies to unlock substantial discounts. Combining auto, home, and other insurances under one provider not only streamlines management but also slashes your overall insurance costs.

Staying Informed: The Key to Long-Term Satisfaction

7. Regular Policy Reviews: Adapting to Life Changes

Life is dynamic, and so are your insurance needs. Regularly review your policies to ensure they align with your current circumstances. Life events such as marriage, the birth of a child, or significant purchases may necessitate adjustments to your coverage.

8. Stay Informed on Industry Trends: Adapting to Changes

The insurance landscape evolves, and staying informed is crucial. Keep an eye on industry trends, new policies, and regulatory changes. This proactive approach ensures you always have the best insurance in an ever-changing environment.

Embracing Technological Advancements: The Future of Insurance

9. Insurtech Revolution: Streamlining Processes for best insurance

As technology continues to advance, the insurance industry undergoes a transformative shift. Explore policies offered by companies embracing Insurtech, where streamlined processes, digital accessibility, and personalized services redefine the way you interact with your insurer.

10. Digital Tools for Informed Choices

In the digital age, knowledge is power. Leverage online tools to compare policies, read customer reviews, and gain insights into the reputation of insurance providers. Empower yourself with information that goes beyond advertisements, ensuring your decisions are well-founded.

Overcoming Common Insurance Myths

Misconceptions about insurance can hinder your quest for the best coverage. Let’s debunk some common myths:

Myth 1: Insurance is Only for the Wealthy

Contrary to popular belief, insurance is not exclusive to the wealthy. There are diverse policies catering to various budgets. Finding affordable options that offer adequate coverage is key to financial security.

Myth 2: You Only Need the Minimum Required Coverage

While meeting minimum requirements is essential, it might not be sufficient. Assess your lifestyle, assets, and potential risks to determine the optimal coverage. The best insurance aligns with your specific needs, not just the bare minimum.

Myth 3: Insurance is Unnecessary for the Young and Healthy

Youth and good health are assets, but they don’t make you immune to risks. Accidents and unforeseen circumstances can affect anyone. Starting early ensures you benefit from lower premiums and long-term financial protection.

Final Thoughts: Empowering Your Financial Journey

In the ever-evolving landscape of insurance, adaptability is your greatest asset. Embrace technological advancements, stay informed about industry trends, and debunk common myths to make informed choices. Remember, the best insurance is a dynamic concept, reflecting your unique circumstances and aspirations.

As you embark on the journey of securing the best insurance, consider it a proactive investment in your financial well-being. Continuously assess your needs, explore emerging trends, and leverage digital tools to ensure you stay ahead in the realm of insurance.

In this pursuit, you’re not just purchasing policies; you’re crafting a shield that protects your loved ones, assets, and future. The path to financial security starts with a well-informed decision today. May your journey be filled with confidence, knowledge, and the assurance that you’re creating a resilient foundation for the uncertainties of tomorrow.