In America, Social Security forms the bedrock of retirement and disability compensation which serves as a lifeline to millions. The social security tax rate is one of the most important parts of this system that aids in funding these benefits. In this blog post, we are going to take a closer look at the Social Security tax rate, its importance, how it is computed and what its effects are to employees and employers as well.

What is the Social Security Tax Rate?

The Social Security tax rate is a percentage of someone’s earnings taken from their salary for purposes of funding the Social Security program. This tax constitutes part of Federal Insurance Contributions Act (FICA) which provides benefits for retired workers, disabled people and dependents of deceased workers. The federal government sets the Social Security tax rate though it may change over time with changes in legislation or economic situations.

Also Read: How Ayushman Bharat Scheme is Changing Lives

Current Social Security Tax Rate

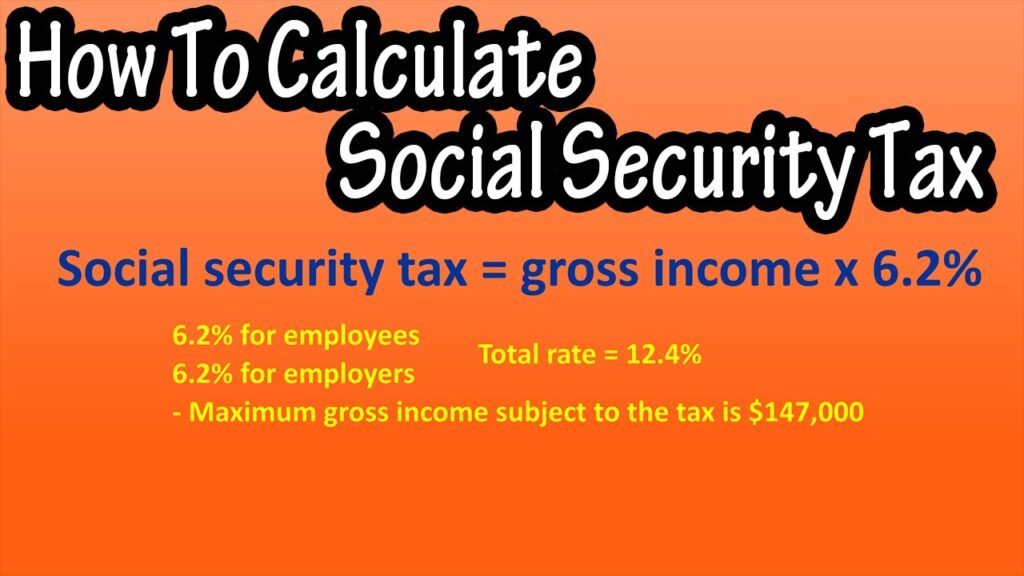

For instance, an employee contributes 6.2% while his employer contributes another 6.2% giving a total contribution of 12.4% towards social security taxes as per 2024 figures. This percentage is applied only on salaries up to the current year maximum limit called social security wage base adjusted yearly: hence it will be $160,200 for this year (2024). This means that any earnings above this threshold are not subject to the Social Security tax.

Breakdown of the Security Tax Rate

The amount of Social Security tax is shared equally between the employer and worker. Each part contributes 6.2% of the employee’s wage up to the limit based on income. But there is a slight difference in tax rate for self-employed individuals. They are required to pay both employee and employer portions, which makes their net earning taxed at a total rate of 12.4%.

The Importance of the Social Security Tax Rate

Social Security tax rate plays a very important role in ensuring that Social Security program keeps running smoothly. All this money is channeled into Social Security Trust Fund which helps in catering for all eligible beneficiaries’ benefits. Were it not for this levy; millions of Americans would not be able to receive financial protection from the social security system.

Historical Changes

The tax rates have gone through various changes since Social Security began in 1935.The initial rate was one percent each for both workers and employers.By the way, over time the rates increased with changing lifestyles for instance in1983 where there were amendments to social security that hiked the rate to 6.2 percent for both employees and employers that has been sustained till date.

How the Social Security Tax Rate is Calculated

The calculation of the Social Security tax rate is a simple thing. It is deducted from the gross pay for employees. As an illustration, when an employee makes $50,000 in one year the social security tax deducted would be equal to $3,100 ($50,000 @ 6.2%). Employers match this amount and contribute another $3100 on behalf of their employees. On the other hand, those who work for themselves often calculate it by applying business expenses to their total earnings.

Impact on Employees

Social Security payroll deduction has a direct impact on take-home pay for employees. In spite of reducing the amount of money they receive in their paychecks, it also ensures that they are participating in an activity which will provide financial support to them at some time in future. Further, employees benefit through employer contributions which double their respective social security accounts.

Impact on Employers

Employers also shoulder the financial burden of Social Security Taxes Rate Employers must match the 6.2% paid by each worker which can be substantial cost particularly for small businesses However, these payments play an important role in helping employers support Social Security as well as take care of retirees and disabled persons among others.

Future Considerations for the Social Security Tax Rate

The future of social security tax rate is an undying argument among policy makers and economists. The aging of the population combined with increasing numbers of beneficiaries could put pressure to re-adjust the tax rate so as to keep the program solvent. Potential changes might involve raising the tax rate, elevating wage base limit, or any other reforms that would guarantee Social Security’s sustainability for future generations.

Note for you

Social Security Tax Rate forms a vital part of Social Security system in order to make sure that funds are available to pay benefits to retired workers, disabled persons, and surviving family members. To appreciate the significance of Social Security on millions of Americans’ financial lives means understanding what the current rate is, how it is calculated and its effect on both employees and employers. As we move forward, discussions regarding future changes regarding social security taxes will continue being central to discussing sustainability and efficiency in this crucial program at large